What Are Futures?

The basic concept of futures is that a futures trade is an agreement between two parties to buy or sell a futures contract at a specific price and time in the future.

You can buy or sell a futures contract across a wide range of markets including stock market indexes, bonds, gold, crude oil and much more.

Trades take place on a centralized exchange that matches and guarantees transactions. Traders can take either a long position (buying the contract) or a short position (selling the contract), depending on their market outlook. Futures traders can then profit based on the outcome of that market outlook prediction.

What is a futures contract?

A futures contract is a standardized exchanged traded contract between a buyer and seller for a specific financial instruments or physical commodity, to be settled at a specified price on a specific expiration date.

A futures contract can be settled in cash, or the buyer can take delivery of the physical commodity based on exchange rules and contract specifications. Each futures contract represents a certain amount of a product or commodity. For example a Gold Futures contracts represent 100 ounces of gold.

In today’s electronic futures marketplace, buyers and sellers are matched and cleared at a well-regulated central exchange, and there is transparent price and order data provided in real- time throughout the trading session.

Benefits Of Trading Futures Contracts

Flexible Trade Sizing

Traders of all experience levels can participate in futures due to a variety of contract sizes available which helps limit financial exposure.

Learn moreDiverse Market Opportunities

Access diverse and uncorrelated markets that drive the international economy including vital commodities which otherwise are difficult to trade.

Learn moreVirtual 24-Hour Trading

Trading opportunities can happen at any time including while the stock market is closed. Futures trade nearly 24 hours a day, six days a week.

Learn moreTax Advantages

Futures trading gains are split between long-term capital gains and short-term gains providing a benefit over short-term stock trading.

Learn moreBuild Your Foundation to Trade Futures

Becoming a consistently effective futures trader requires discipline to follow a trading plan, consistent risk management and emotional control.

What is the Relationship Between Leverage and Margin in Futures Trading?

Leverage is the ability to control a larger position with less capital, while margin is money set aside from a trader’s account as a guarantee against trading losses. These two important trading concepts work together to provide the financial framework for futures trading.

- Leverage provides traders with much greater buying power than most other trading instruments and allows a trader to put on more positions and trade larger numbers of contracts than otherwise possible.

- Margin is the amount of money needed in your account to open and maintain a new futures position. The margin amount is determined by the exchange and set based on potential volatility, liquidity, and pending news events.

Although increased leverage allows for potentially greater profits, it also comes with increased risk and the potential for greater losses. Defining a risk management strategy is a beneficial step to help traders protect their account.

How To Trade Futures

Like many industries and occupations, futures trading comes with its own unique processes and vocabulary that all traders should know before placing that first futures trade. Let’s get up to speed and learn how to trade futures with an introduction to order types, margins and leverage, contract symbology, and more.

Develop The Trader In You

Get started on your futures trading journey with our exclusive video series. Watch an introduction to the basics along with actionable take aways to help you learn how to trade futures.

Get Started With A Futures Trading Brokerage Account

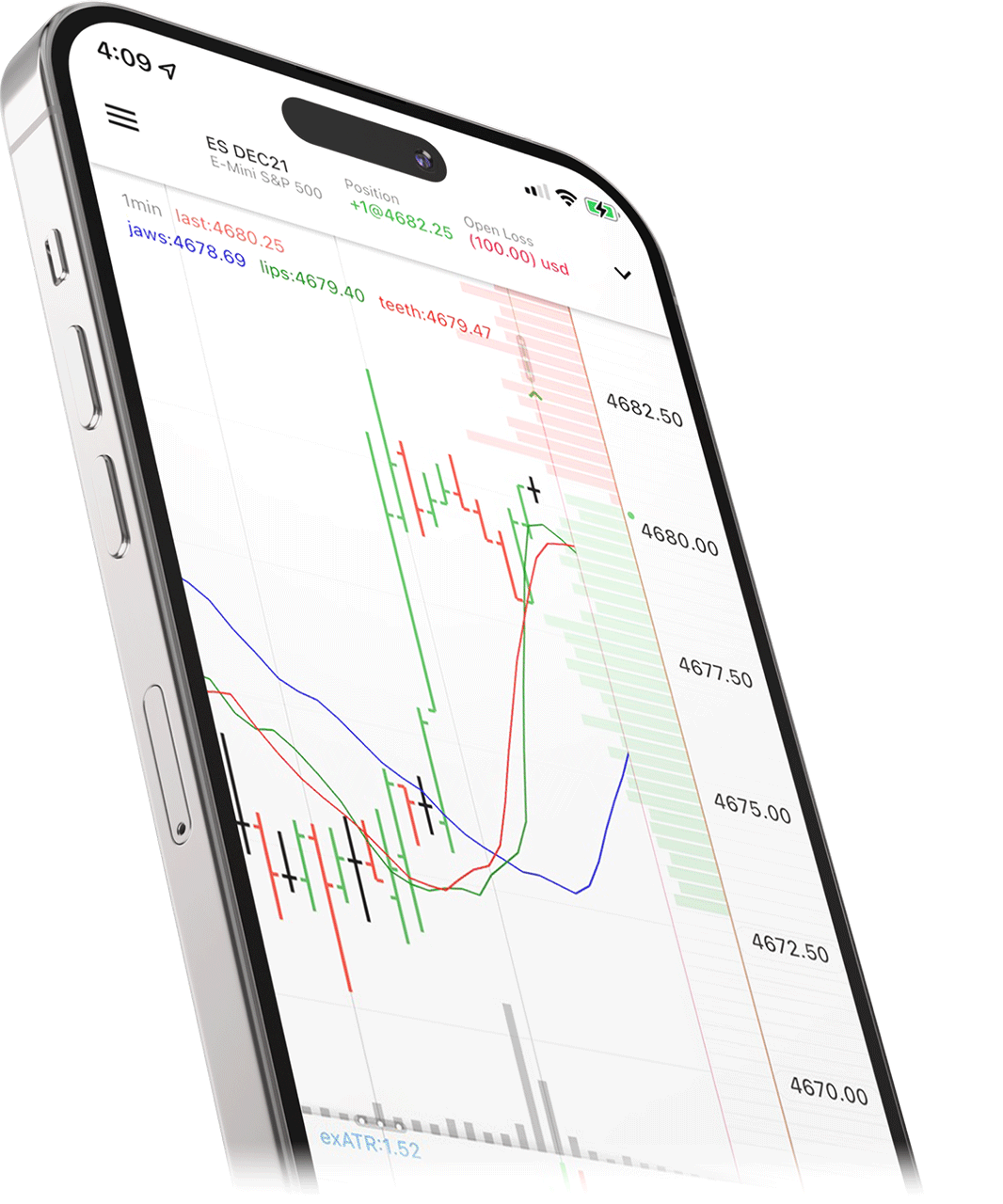

A funded futures account with a licensed futures broker is required to trade futures. The first step to get started is to open a futures trading account with a reputable experienced broker. The broker will provide access to an online trading platform and a live market data connection that will allow you to trade futures contracts from your computer or mobile device.

We hope you will consider NinjaTrader as your futures broker of choice.