Monte Carlo Simulation Report

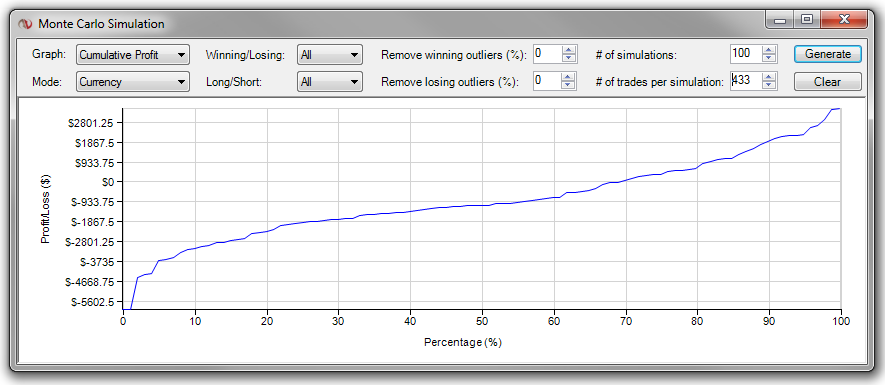

The results of the Monte Carlo Simulation are displayed in a graph below the parameters.

X-Axis

The horizontal axis of the Monte Carlo Simulation graph shows the percentage of simulations that have fallen below the Y - axis value. For example, if you run a Monte Carlo Simulation setting the # of Simulations to "100" and using the Cumulative Profit graph, the intersection of the 50% X - value and the associated Y value means that 50 of your simulations will be below that cumulative profit/loss value, and oppositely the remaining 50 simulations will have a greater cumulative profit/loss. The above screenshot shows an example of a worst case scenario of the strategy losing $5602.50 and a best case scenario with the strategy making $2801.25. This type of report allows you to analyze if the risk/reward ratio between worst and best case scenarios is acceptable or not.

Y-Axis

The vertical axis of the Monte Carlo Simulation graph displays the measured unit for the Graph item selected such as Profit/Loss, statistical information, or time.

|